vermont state tax withholding

You should obtain your EIN as soon as possible and in any case before hiring your first employee. Provided the state does not have any outstanding Title XII loans payment of state unemployment taxes in a timely manner reduces the federal unemployment tax rate from 60 to 6 so it is important to pay your state unemployment.

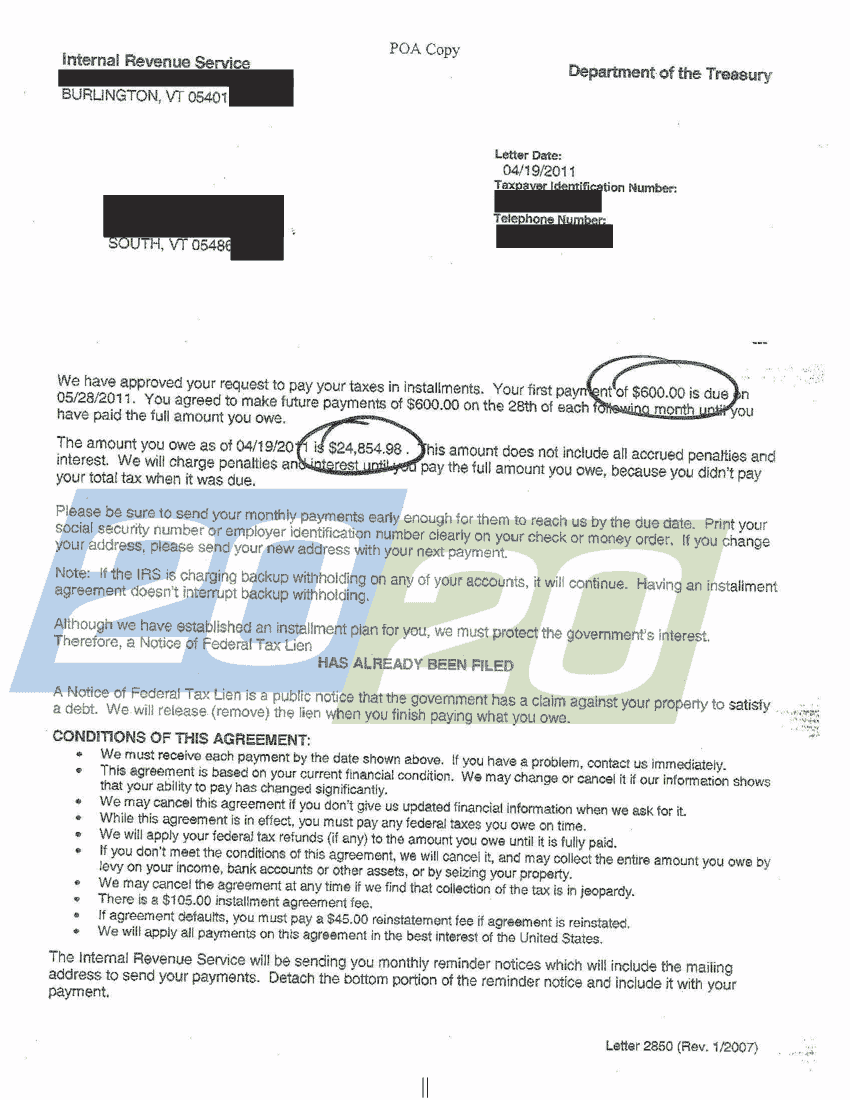

Successful Tax Resolutions In Vermont 20 20 Tax Resolution

Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in.

. The 2022 rates range from 08 to 65 on the first 15500 in wages paid to each employee in a calendar year. Federal W-4 Instructions New State W-4 VT. On an annual basis the department and IRS conduct a cross match to ensure that employers are paying both taxes.

The Single or Head of Household and Married income tax withholding tables have changed. Divide the annual tax withholding by 26 to obtain the biweekly Vermont tax withholding. The income tax withholding for the State of Vermont includes the following changes.

The Vermont Department of Taxes released its 2019 state income tax withholding tables and guide. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. Individuals Personal Income Tax Withholding.

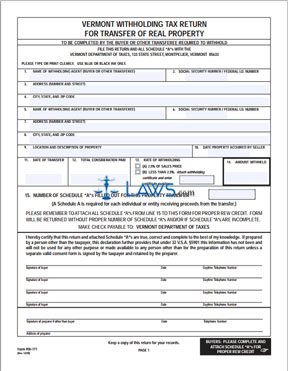

If Federal exemptions were used and there are additional Federal withholdings proceed to step 8. No action on the part of the employee or the personnel office is necessary. In Vermont sellers of real property who are not residents of the state are subject to a real estate withholding tax collected at the time of closing.

Changes to Vermont W-4. The annual amount per allowance has changed from 4400 to 4500. State W-4 VTs are also completed at the time of hire and can be updated as often as needed throughout the calendar year.

If youre a new employer congratulations on getting started rates range from 1 to 48 depending on your industry. Subtract the nontaxable biweekly Thrift Savings Plan contribution from the gross biweekly wages. For example if you want your employer.

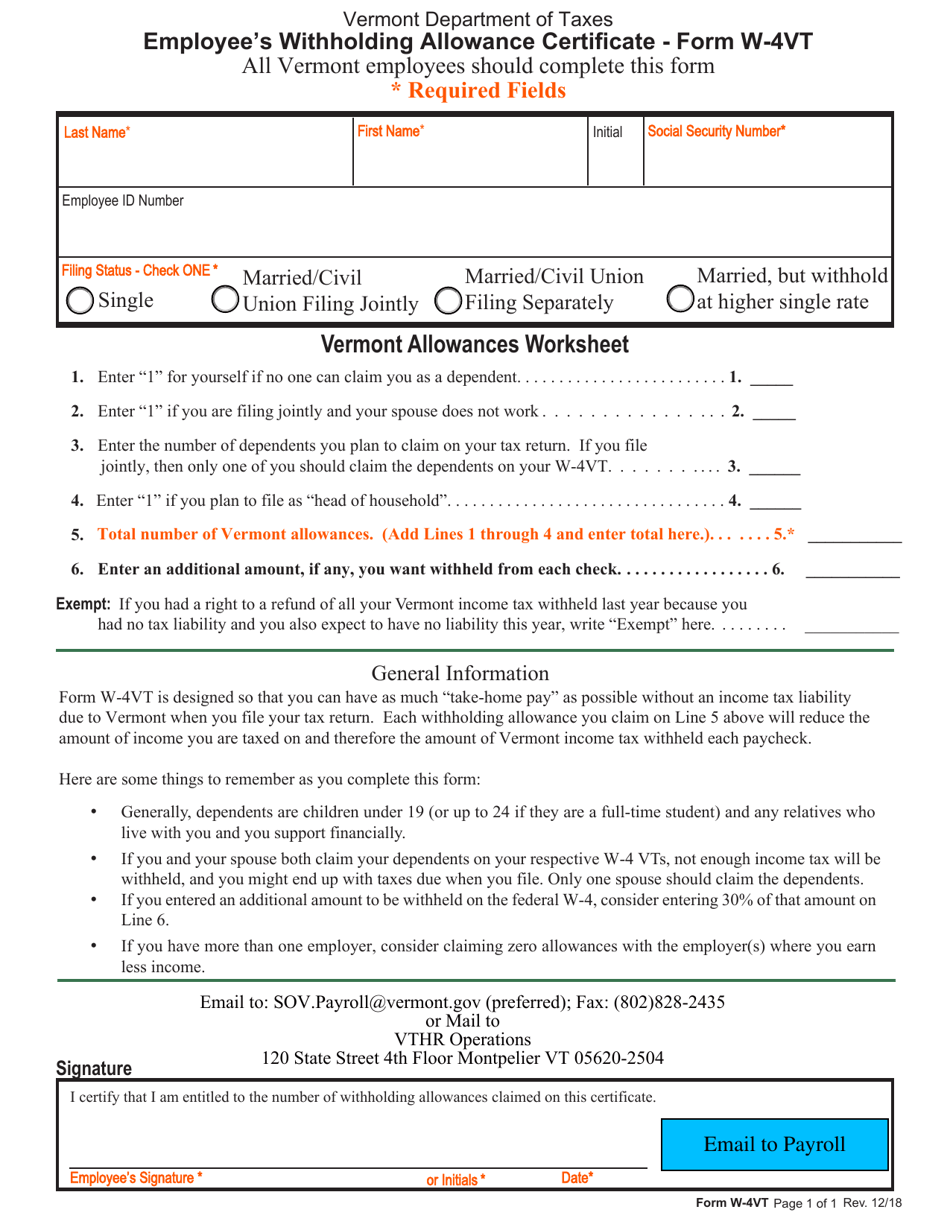

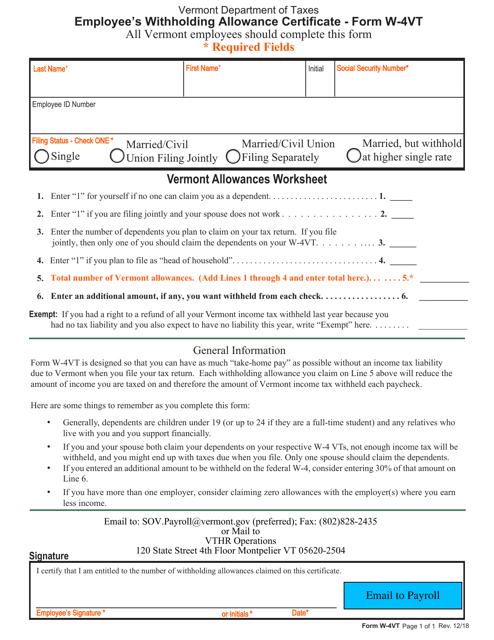

As an employer in Vermont you have to pay unemployment insurance to the state. Form W-4VT Employees Withholding Allowance Certificate 1983 KB File Format. Generally dependents are children under 19 or up to 24 if they are a full-time student and any relatives who live with you and who you support financially.

Vermont State Unemployment Insurance. Ad Download or Email VT TA-VT-05 More Fillable Forms Register and Subscribe Now. Vermont taxpayers would have seen a 30 million increase in their state income taxes and Vermonts non-profit sector may have seen diminished giving as.

New Federal W-4 FAQs. The amount of the tax is 25 of the gross sale price eg with a contract sale price of 25000000 the withholding tax is 625000. When you start a new job your employer will ask you to complete a federal Form W-4 the Employees Withholding Allowance Certificate and a Form W-4VT for Vermont withholding.

To help employers calculate and withhold the right amount of tax the IRS and the Vermont Department of Taxes issues guides each year that include withholding charts and tables. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Withholding Formula Vermont Effective 2022.

Once the employer has the information youve entered on forms W-4 and W-4VT the employer is able to calculate your withholding tax. Apply the taxable income computed in step 5 to the following table to determine the annual Vermont tax withholding. The annual amount per allowance has changed from 4350 to 4400.

Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute taxable income. The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data. Taxpayer Services Division PO.

Relying on your existing withholding allowances could result in a mismatch between your 2019. Ad Download or Email VT WHT-434 More Fillable Forms Register and Subscribe Now. The states top income tax rate of 875 is one of the highest in the nation.

If Federal exemptions were used and additional Federal tax was withheld multiply the additional amount by 27 percent and add that to the result of. The Vermont Income Tax Withholding is computed in. Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis.

Overview of Vermont Taxes. Because the federal and Vermont income tax calculations differ. The Single or Head of Household and Married income tax withholding tables have changed.

The income tax withholding for the State of Vermont includes the following changes. Ad Fill Sign Email VT WHT-434 More Fillable Forms Register and Subscribe Now. Each withholding allowance you claim on Line 5 above will reduce the amount of income you are taxed on and therefore the amount of Vermont income tax withheld each paycheck.

These forms help your employer calculate how much income tax to withhold and pay from each paycheck. State of Vermont Department of Taxes. Exemption Allowance 4400 x Number of Exemptions.

A reproduction of the 2019 annual percentage method withholding tables begins on page 2. Vermont has a progressive state income tax system with four brackets. With rare exceptions if your small business has employees working in the United States youll need a federal employer identification number EIN.

The policy behind this tax is to allow the state to grab. If you want even more control over your tax withholding you can also specify a dollar amount for your employer to withhold. No action on the part of the employee or the personnel office is necessary.

Vermonts new Form W-4VT Employees Withholding Allowance Certificate was redesigned so that you can keep as much take-home pay as possible without creating an income tax liability due to the State of Vermont when you file your tax return. Up to 25 cash back Here are the basic rules on Vermont state income tax withholding for employees.

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

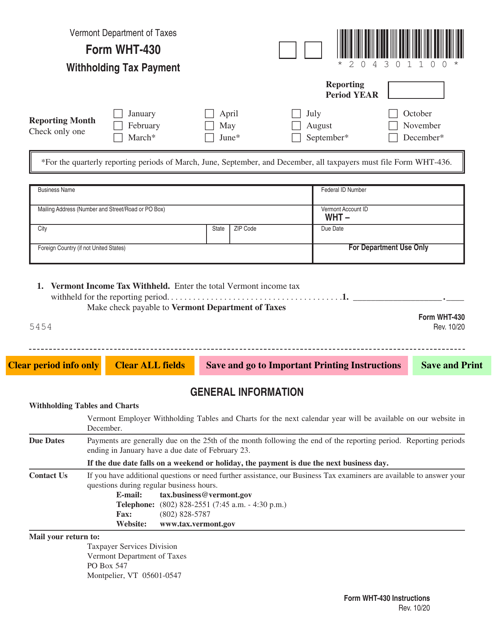

Vt Form Wht 430 Download Fillable Pdf Or Fill Online Withholding Tax Payment Vermont Templateroller

Vermont Income Tax Vt State Tax Calculator Community Tax

Individuals Department Of Taxes

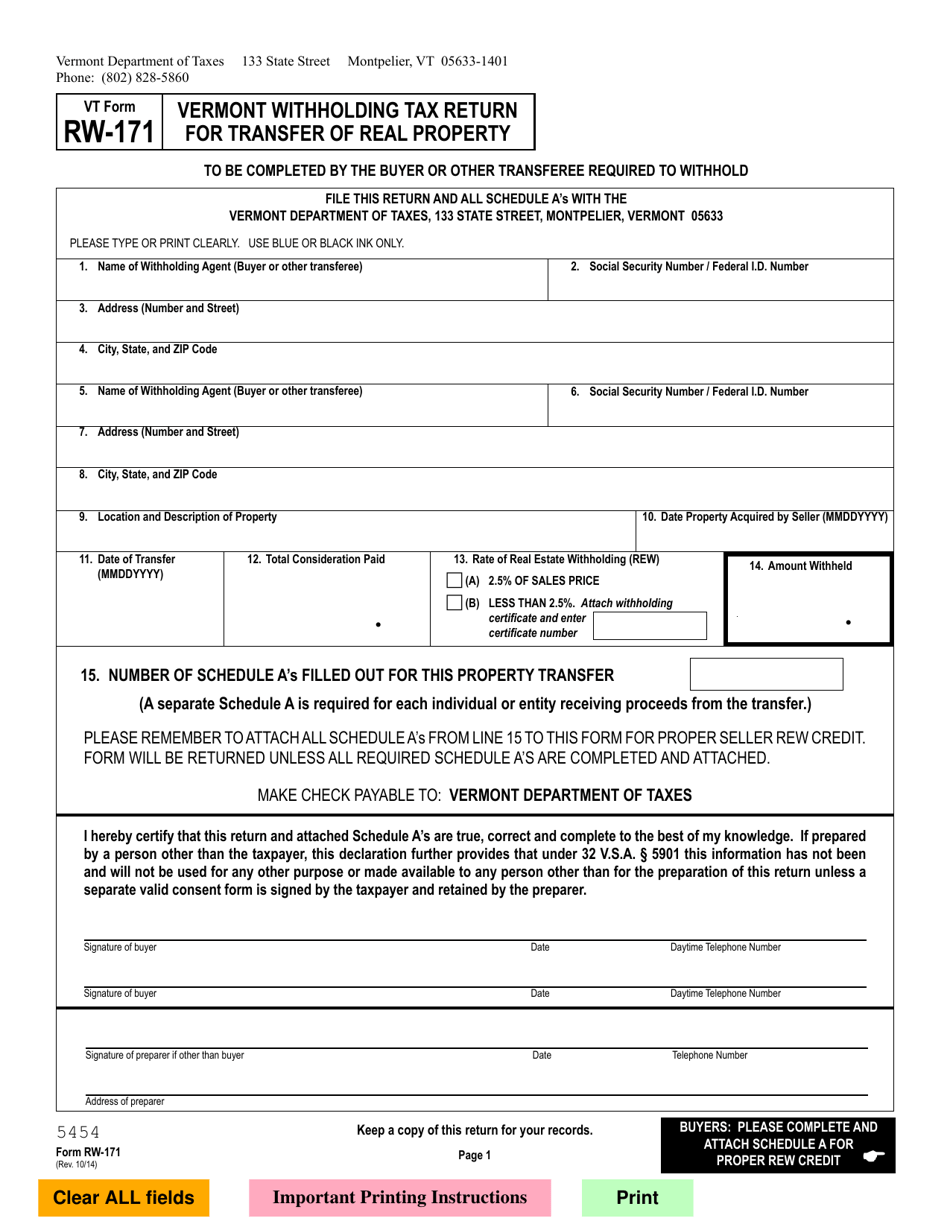

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller

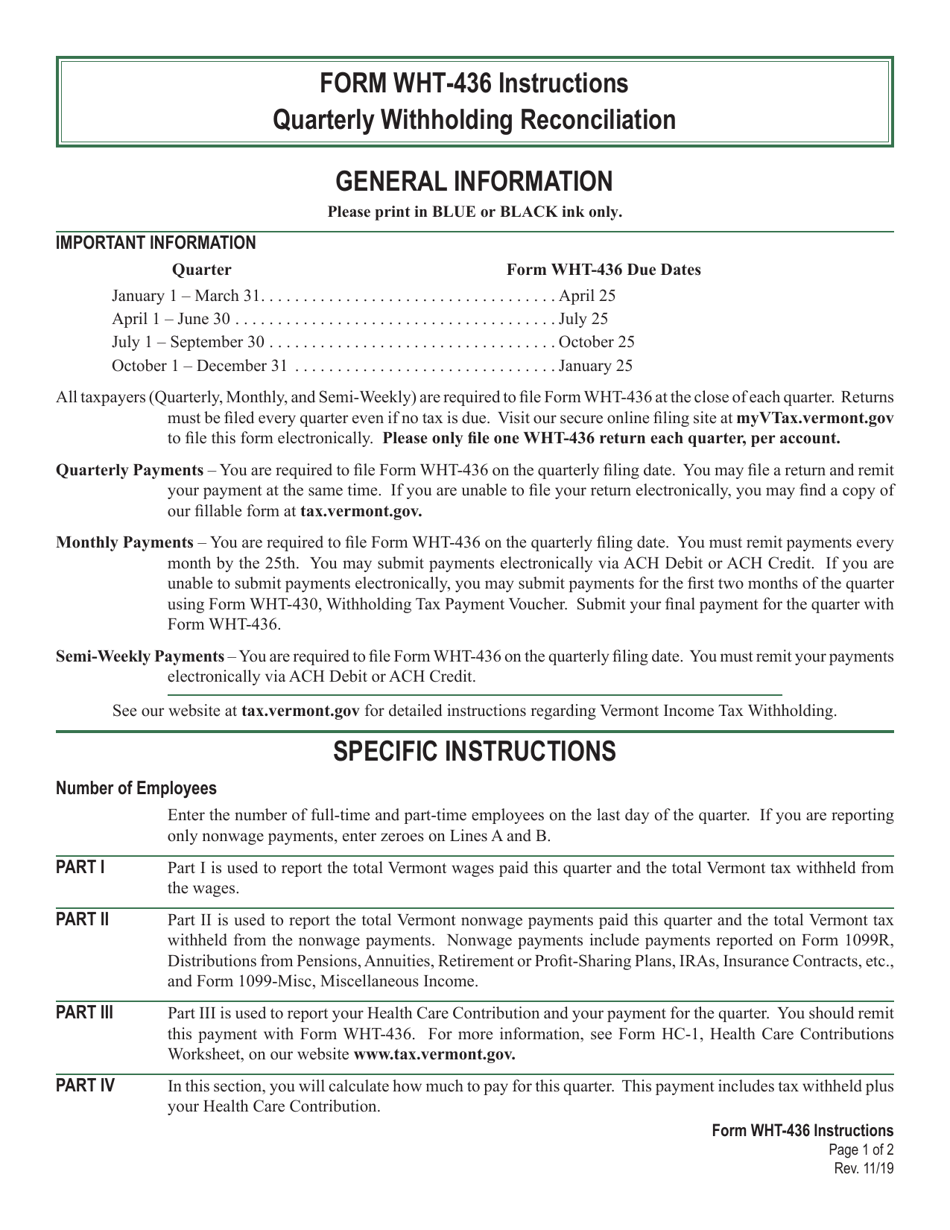

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

Vermont State Form W 4 Download

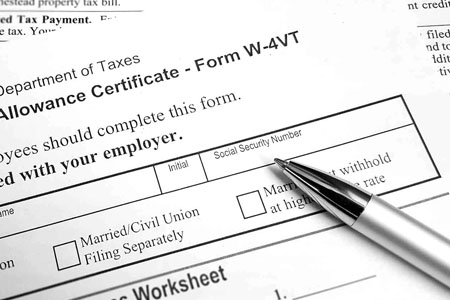

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

Vermont Income Tax Vt State Tax Calculator Community Tax

Free Form Rw 171 Withholding Tax Return For Transfer Of Real Property Free Legal Forms Laws Com

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller